Argentina’s pecan industry, a thriving and growing sector

Pecan farm Finca Ruta 80 in the Santa Fe Province, Argentina.

With a timid but growing participation in international markets, a series of characteristics make Argentina an ideal place for growing pecans: suitable soils, water availability, optimal climatic conditions, the essential agricultural know-how, and the advantage of offering product in the counter season, from June to September. Although Argentina’s pecan production currently represents a low share compared to the world’s main producers, Argentina’s potential is very high, expecting to reach 10,000 tons of production in five years. It is a young but thriving sector that knows where it wants to go and how to do it.

Located in the southern hemisphere of the American continent, the Argentine Republic extends from 22 degrees to 55 degrees south of the equator and is bordered by Uruguay, Paraguay, Brazil, Bolivia, and Chile, and the Atlantic Ocean to the east. Argentina is commonly described by its striking contrasts and its varied geography and climates, all of which facilitate the development of rich flora and fauna. Thus, the country is suitable for the cultivation of all kinds of agricultural products.

The climate offers a wide range of conditions suitable for the cultivation of pecan, which covers an important area in the north and center of the country, currently reaching between 1,000 and 1,500 tons of annual production. Although there are no official statistics, there is good consensus on general data in the sector. Planted pecan trees cover an estimated 15,000 hectares in Argentina. These plantings are distributed mainly in three regions with optimal agroecological conditions for its development: the main area from Central East to Northeast; the Northwest area in the Central Region; and the dry area with incipient growth in the province of Catamarca. There are also orchards scattered throughout the rest of the country.

Located in the northeast region, Entre Ríos is the province with the largest planted area, concentrating more than 50 percent of Argentina’s production. In the south of the province, in Villa Paranacito, a group of pecan growing companies works together as a single operation under the management of FARO Capital, Grupo Alto Pecan. With 1,500 planted hectares, it is the largest grower in the southern hemisphere.

Joaquin Torassa, Director Grupo Alto Pecan and Director Argentine Pecan Committee at Día del Nogalero 2019, Chihuahua, México.

“The production in Argentina occurs mainly in humid areas with rains ranging between 1,000 and 1,500 millimeters per year, with characteristics similar to the production areas of the southeastern United States, so the varieties developed there adapt very well here,” explained Joaquín Torassa, Grupo Alto Pecan’s Director. “An important difference between one and the other is the availability of solar radiation that Argentina’s humid zones have, which are closer to the values of the dry zone of the United States and Mexico. The availability of groundwater with excellent irrigation quality also stands out. Production in the dry zone, with characteristics more similar to those of the western United States or northern Mexico, is incipient with 500 hectares planted, but with great production potential as well.”

Most orchards install a drip or sprinkler irrigation system that complements the rainfall regime except in the dry zone.

As most of the production in Argentina takes place in humid areas, pecan scab is the main disease affecting production. However, since it is a crop that is only a few years old and is geographically widely dispersed, the incidence is much lower than it is expressed in Georgia. Second in importance is the downy spot and, in highly agricultural areas, the bed bug is usually present when jumping from other extensive crops.

The pecan sector is made up of 300 to 400 producers. Most of these operations are small, with less than 15 hectares, and medium, with up to 50 hectares; these producers’ pecan production serves as a secondary or complement to their main agricultural activity. The oldest ones are almost all small, while the productions over 50 hectares have only been developed in the last 10 to 15 years. The estimated nominal annual growth ranges between 700 and 900 hectares per year.

Tree spacing on orchards varies but the most common spans between 70 and 100 trees per hectare. The goal is to work with smaller trees to facilitate operational management tasks and avoid very high densities in order to maximize good air circulation and minimize the proliferation of fungal diseases. In some areas, narrower spacing and canopy size are also being tested for up to 200 pecan trees per hectare.

The commercial varieties used in Argentina come from the USDA Germplasm Bank, the main ones being: ‘Desirable,’ ‘Pawnee,’ ‘Stuart,’ ‘Kiowa,’ ‘Mahan,’ ‘Sumner,’ ‘Oconee,’ ‘Cape Fear,’ ‘Harris Super,’ ‘Kernodle,’ and ‘Success.’ Likewise, the first ‘Western’ and ‘Wichita’ trees have already been planted in the dry areas in Catamarca, whose production is expected to be seen in the coming years.

“The main varieties express very well in the climatic conditions of Argentina, resulting in very good-sized nuts. In 2019, 46 percent of the exported nuts were Oversize, and 40 percent were Extra Large. The availability of varieties of high international demand with good size makes them suitable for the Southeast Asian market, while the nuts of smaller size and higher kernel yield are destined to the shelled market, to be sent to the European Union or the Middle East,” Torassa said.

The sector’s commercial strategy focused on exports initially and, therefore, organized its entire production structure for this purpose. In Argentina, there are cleaning plants of different sizes that belong to the producers themselves like Grupo Alto Pecan, to trading companies and companies that provide services to the sector, and also to cooperatives.

Associativism, which refers to collective cooperation, has become a fundamental tool for export. Since its inception, small and medium-sized producers have been grouped in consortiums for this purpose. Over time, another player in the value chain appeared—the marketer. More recently, with the increase in exportable products’ availability, vertically integrated producers also entered the supply chain and export pecans directly.

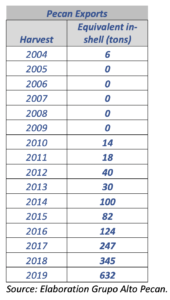

Argentina’s first pecan export was sent to Italy in 2004 for 7,000 kilos, but it was not until 2010 that it began to do it in a sustained way and in increasing volumes. From 2010 to 2019, exports grew at a compound annual rate (CAGR%) of 43 percent, which means they have almost quadrupled in the past 10 years.

Although there was some variation in general, exports increased between 2010 and 2015. Starting in 2016, they began to almost double annually, as a result of the development of orchards, which are mostly young, and of the new generation of orchards that are entering production.

Argentina also exports shelled pecan, having reached demanding markets such as Europe and the Middle East, showing a promising future.

In the same way that the volume of shipments has increased, destination markets have diversified. To date, Argentine pecans have reached Europe, the United States, Vietnam, Hong Kong, Thailand, Brazil, the Middle East, and Russia in their different forms.

But it was not an easy road. On the contrary, most of these markets were developed by external circumstances that forced Argentina to seek commercial alternatives for their production. Until 2018, Argentine exports were mostly destined for southeast Asia. This situation ended when the trade war between China and the United States began, and the former imposed severe restrictions on the imports of nuts from the latter, which complicated the entry of merchandise from Vietnam and Hong Kong, directly affecting the commercial relationship that Argentine companies had with their clients in these countries.

“At that time, we understood the importance of having the authorization to be able to export to China directly. From the beginning, we knew that it was a long process and that, in the meantime, we had to develop other markets to channel existing supply. Thus, arduous work began in a coordinated way with the federal government to identify those markets that were open for our pecans and to open new markets that were interesting for the sector,” Torassa highlighted. Negotiations to access China are currently in progress and heading to their final stages.

The rapid development of the pecan sector is the result of the joint work of all the actors in the chain who found in associativism a tool to respond to everybody’s demands and as a vehicle for public-private articulation aimed at improving the sector’s competitiveness. The Argentine Pecan Committee is the institutional umbrella that brings together all associations related to pecan, made up of more than 200 producers and other players in the value chain—such as nurserymen, traders, and companies that provide production services.

“The Committee was born as a consequence of the development and growth of different regional associations, in response to the natural need to find a common entity that represents all of them on national and international issues,” Torassa, who is also Director of the Argentine Pecan Committee, said. “It is a single organization, with a unified message that allows us to build a relationship and work with the public sector and with the technical institutions that support the technological advance of the sector. We have 3 pillars on which we focus our work: development of internal and external markets; generation of statistics of the sector; and promoting the implementation of Good Agricultural and Manufacturing Practices.”

The pecan industry in Argentina, although young, looks promising. New generations of orchards entering production, others going into their most productive stage; young producers not only eager to learn but also invest in state-of-the-art technology to be more efficient and have the best quality product, and collaboration as a key premise to gain competitiveness are all factors that contribute to the continued growth of the Argentine pecan sector.