Effective Marketing Begins with Good Research

One of the biggest problems encountered in developing successful marketing campaigns is that many people equate advertising with marketing. The problem with this approach is that advertising is, in essence, the outcome of the entire research-based process while marketing involves each of the elements (e.g., research, segmentation, targeting, and the marketing mix) necessary to create an advertisement that will motivate consumers to buy your product.

With this in mind, we define marketing as the set of activities necessary to create, communicate and deliver an offering to a specific customer segment in a mutually agreeable manner profitably. This definition is based in part on the 7 R’s which seek to satisfy customer wants and needs by delivering the right product to the right place in the right quantity in the right condition to the right customer at the right price at the right time.

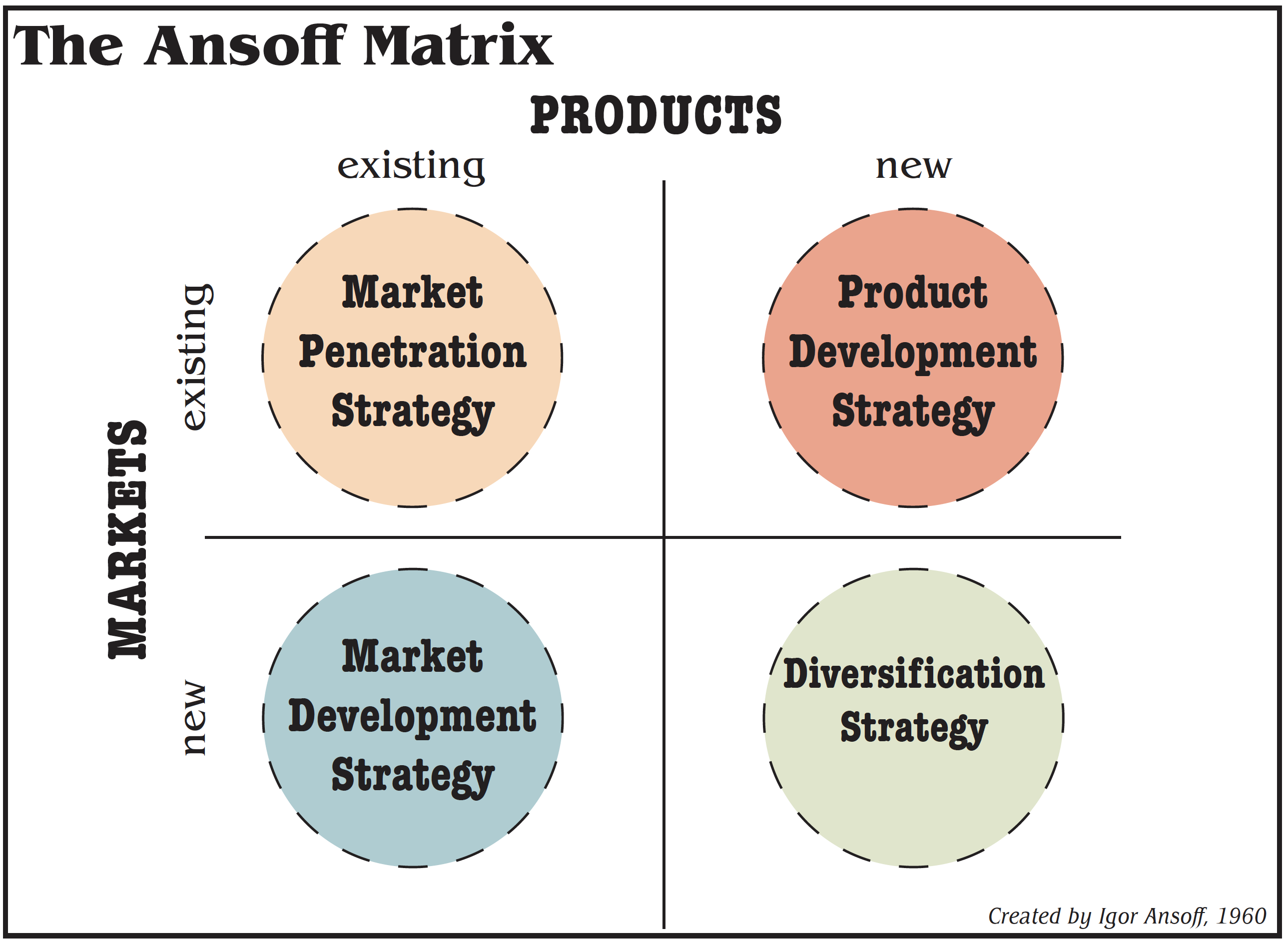

When developing a new strategy, decision-makers frequently begin with the Ansoff Matrix. The Ansoff Matrix, also known as the Ansoff product and market growth matrix, is a marketing planning tool that aids businesses and industries in selecting the product market strategy that best aligns the organization’s abilities with the market’s potential. Strategic focus is determined by focusing on whether the products and the market are new or existing. The Ansoff Matrix has four market strategy alternatives: market penetration, product development, market development, and diversification.

- Market Penetration Strategy: involves selling more of your existing product to existing domestic customers. This strategy requires a clear understanding of who your customers are and the benefits that they seek to fulfill.

- Product Development Strategy: involves developing new products that can be sold to existing customers. This strategy is based on in-depth research necessary to determine which product variations customers may be interested in. Examples of a product development strategy might include products such as pecan butter or pecan energy bars.

- Market Development Strategy: this strategy is based on introducing your current product to new (international) markets. The primary risk of this strategy is that you may inadvertently create new competition as is the case with China.

- Diversification Strategy: this strategy is based on developing unrelated products which will be marketed to new customer segments.

After having selected the appropriate overall strategy or strategies, the next step in developing a successful marketing program is to break the market into segments, which all share similar characteristics. It is important to note that each market segment must be large enough to be identifiable and measurable; they must be accessible by the marketing mix; the segment must want or need the product, and most importantly, the segment must be able to be served profitably. Markets are typically segmented based on the following criteria: geography, demographics, psychographics, benefits sought, and usage rate.

- Geographic Segmentation: segmenting the market based on its geographic location, the market size or density (regions, metropolitan areas, countries, etc.).

- Demographic Segmentation: segmenting the market based on criteria such as age, gender, income, ethnicity, education, and the individual’s stage in the family lifecycle among others.

- Psychographic Segmentation: personality, motives, lifestyle (retirees, healthcare professionals, the outdoors type, etc.),

- Benefit Sought Segmentation: involves grouping customers into market segments according to the benefits they seek from the product (good taste, nostalgia, health benefits).

- Usage Rate Segmentation: involves dividing the market based on the amount of product bought or consumed (e.g., roadside vendors, small local processors, commercial shellers).

Upon completion of the segmentation process, the next step is to identify which of the target markets (segments) are most likely to be receptive to and willing to act on your marketing message. There are three strategic orientations that may be adopted: an undifferentiated or mass market strategy, a multi-segment strategy which targets two or more segments of the market, or a concentrated strategy which targets a single market segment. Strategies that adopt an undifferentiated or mass market targeting strategy view the market as a single entity with no differentiating characteristics and utilize a single marketing mix in the hope that someone will respond to their message. Targeted strategies, which focus on single or multiple subsets of the market, develop specific marketing mixes and message for each segment based on the segments’ specific needs. The primary caution when adopting a multi-segment strategy stems from the fact that some individuals may also be members of other segments so the message must be consistent across groups in order to avoid confusion.

The next step in developing a successful marketing program is to adjust the marketing mix in order to serve the targeted segments effectively. The marketing mix is based on four elements: product, place, price, and promotion. Pecan growers have historically focused their efforts on the product portion of the marketing mix as it is the only element that they have any direct control over and due to the time that it takes to bring an orchard into production. The downside to this approach is that growers may select varieties that do not possess the qualities (e.g., color, taste, shelf life, etc.) desired by food processors or consumers. Consequently, we need to know more about each segments’ expectations in order to better serve them.

The second aspect of the marketing mix that must be considered is the element of place. The place element involves many important processes that must occur in order to have the right product available to the right customer in the right quantity at the right time. As new market segments are developed every aspect of the place component can be expected to change as each segment can be expected to have different peak selling times, packaging and storage requirements as well as transportation specifications (refrigerated vs. non-refrigerated).

The third aspect of the marketing mix is price. Decisions related to price are often the hardest to make but the fastest to implement. Pricing decisions are especially difficult when viewed from the customers’ perspective because they involve tradeoffs. When making purchase decisions, some customers subconsciously ask themselves “What do I have to give up to buy this product?” or “What can I substitute for this product and still obtain satisfactory results at a cheaper price?” Alternatively, if the price is too low consumers may develop unrealistic expectations while prices that are too high reduce the number of pecans demanded.

The fourth and final aspect of the marketing mix is promotion. The primary purpose of this stage is to communicate with the intended market segment in order to maintain or increase sales. Effective promotional campaigns provide the right message at the right time to the right target market in order to satisfy the customers’ needs, wants, and desires. Promotional campaigns may be based on advertisements, point of sale displays, or stealth marketing. Stealth marketing programs are unique because they do not require extensive research bases and because they are people-to-people driven rather than top-down company to customer and are more likely to be trusted and acted upon.

Stealth marketing can occur in many forms. Unintended stealth marketing occurs when magazines, that have dedicated cooking sections, feature dishes made with pecans which leads to an increase in pecan sales. Alternatively, intended stealth marketing occurs when growers send shelled pecans to friends and family that don’t have ready access to new crop pecans during the holiday season. Given the fact that new crop pecans from a known source are virtually unheard of in many parts of the country, they are sure to be appreciated and shared which increases consumer awareness. Growers who want to participate in stealth marketing but are unsure how to start can begin by sharing Pecan South’s social media posts which frequently include recipes. You can also send your best recipes along with a nice photograph to Catherine Clark, Pecan South’s managing editor, at pecansouth@tpga.org.

Obviously, the process of developing an effective advertising campaign that increases long-term demand takes time and money. Unfortunately, given current market conditions, the pecan industry needs to increase domestic demand quickly. Doing so will, in all probability, require the development of both long- and short-term strategies simultaneously. From a long-term perspective, the pecan industry may want to consider partially funding academic research or assisting in data collection which will lead to the identification of new market segments and ultimately provide the basis for more effective marketing campaigns. The pecan industry also needs to begin working to develop a platform upon which future advertising campaigns can be based. Pecan growers can help increase demand simply by sharing social media posts, selling a portion of their crop to roadside vendors, and sending pecans as Christmas presents. In the end, we must all work together so that the pecan industry remains viable.

Until next time I will leave you with a few of the questions that must be answered so that we can do a better job of serving our customers.

- What are the characteristics of our current customers? Of potential customers?

- Which segments can we reasonably expect to convert from prospects to customers?

- What is the preferred manner of consumption for each segment?

- What is the most effective way to communicate with each segment?

- Which advertising message is most likely to motivate each segment to purchase?

- When, where, and how often should the segment be exposed to the message?

- What does the ideal pecan look like and taste like to each segment?

- What type of packaging is preferred by each segment?

- How does each segment perceive the price of pecans relative to other alternatives?