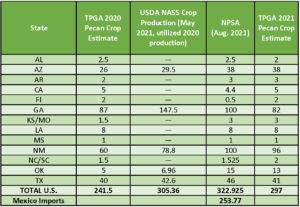

July 2021 Position Report shows declining inventory, steady exports

The July 2021 Position Report provides insight into pecan market and handler's summer inventory as harvest nears.

Light green regrowth on pecan trees in late July 2020, following hedge-pruning in June 2020. (Photo by Lenny Wells)

Over the past few months, industry members have reported that the market appeared to be slowly gaining strength. Prices increased and U.S. handlers’ inventory dropped. The most recent Position Reports give credence to these reports.

Inventory dips below 2018/2019 levels

Continuing its downward trend for the current year, total inventory held by U.S. handlers dropped below 2018/2019 crop year levels for the first time since September 2020. According to the July 2021 Position Report, U.S. handlers had a total of 178,115,558 pounds (inshell basis) in their inventory at the end of July.

Since February, total inventory declined steadily and experienced a sharp drop in July. Based on the last two years, upcoming reports should show that total inventory decreasing up into the end of September as harvest starts up.

Another publication useful for analyzing current pecan inventory in the U.S. comes from the U.S. Department of Agriculture. The USDA NASS releases monthly cold storage reports showing the stocks of meats, dairy products, poultry products, fruits, nuts, and vegetables in public, private and semi-private refrigerated warehouses. The data is gathered through voluntary reporting.

In the August 2021 report, USDA NASS states that 215.9 million pounds inshell basis (converted shelled by multiplying by “2”) sat in cold storage as of July 31, 2021. The July publication reported that 244.7 million pounds were held in inventory on June 30, 2021. Mirroring the APC’s Pecan Position Report, these publications from USDA NASS indicated the total pecans in cold storage has steadily decreased through the summer.

In the July 2021 Position Report, the “Pecans Received” data point provided further context to pecan’s movement. This number shows the amount of pecans U.S. handlers took in throughout the month. According to the most recent report, U.S. handlers received approximately 1.8 million pounds (inshell basis) throughout July. This number marked a 39 percent decrease from July 2020. The year-to-date total for “Pecans Received” continues to be above the previous year’s levels, as expected after Georgia and New Mexico harvested large crops in 2020.

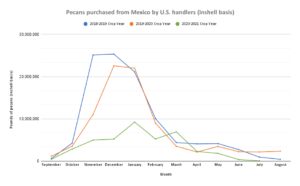

U.S. handlers’ smaller inventory could also be linked to a decline in pecan imports. According to the July 2021 Position Report, U.S. handlers purchased 759,702 pounds (inshell basis) from other production areas. Of that, only 43,200 pounds came from Mexico.

The year-to-date totals also reflected a drop in pecans purchased from outside the United States. At the end of July, U.S. handlers had brought in 43.88 million pounds (inshell basis) of pecans from outside the country, marking a 47 percent decrease from the 2019/2020 crop year.

As mentioned in Pecan South’s analysis of the May 2021 Position Report, U.S. handlers reportedly have begun to look beyond Mexico for pecans. The year-to-date purchases of pecans from Australia and Argentina have both increased; imports from South Africa also made an appearance on the July report.

With the new American Pecan Promotion Board in place, these imported pecans will also be assessed, and the monies collected will go toward pecan research and promotion efforts.

More shipments and commitments leave fewer pecans in cold storage

According to the June and July 2021 Position Reports, shipments dipped in June and rose slightly through July yet remained below last year’s levels for those two months. According to the July 2021 report, total shipments (inshell basis) hit 22,287,423 pounds. Even with this drop, the year-to-date total for pecan shipments continued to outpace last year’s shipments.

These total shipments include pecans sent to grocery stores and those transferred between handlers. The most recent report showed that U.S. handlers shipped more pecans to other handlers during July. In future reports, industry members can expect to see an increase in the number of pecans reported as “inter-handler transfers received” once handlers receive those shipments.

U.S. handlers also reported 1,259,177 pounds of inshell pecans to retail stores, groceries, and exports throughout July 2021. According to the report, this number increased 18,688 percent from July 2020.

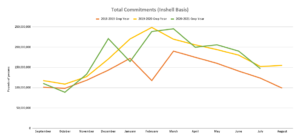

Total commitments for the 2020/2021 crop year continued to follow an erratic trend during July. The July 2021 Position Report indicated a slight drop in total commitments, which came to about 146.86 million pounds (inshell basis).

Within the data for commitments, the position report included numbers for those nuts committed to the domestic and export markets. U.S. handlers shared that they had 3.54 million pounds of inshell pecans committed for the domestic market at the end of July. When compared to July 2020, this number increased by 592 percent.

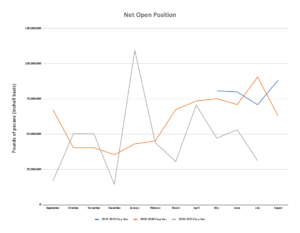

The Net Open Position is another important value for analyzing commitment and inventory. The American Pecan Council began releasing the Net Open Position in May 2020; this number reflects the pecans in U.S. handlers’ inventories available for purchase at the end of the reporting month.

Like total commitments, the Net Open Position jumped and dropped several times throughout the 2020/2021 crop year. This pattern continued in the summer, rising in June and dipping in July. According to the July report, U.S. handlers had 31.26 million pounds available at the end of the month—a 65 percent decrease from July 2020. In fact, U.S. handlers ended July 2020 with approximately 90.55 million pounds available.

The Net Open Position tells the number of pecans held in U.S. handlers’ inventories that are not committed and are available for sale.

As the Northern Hemisphere enters harvest in the coming month, the Net Open Position provides an insight into U.S. handlers’ cold storage, specifically how many uncommitted pecans are on hand. These uncommitted nuts compete directly with the new crop and, in years past, have caused prices to decline.

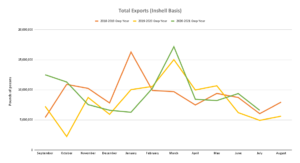

Total exports remain above last year’s levels

After reaching their peak earlier, total exports for the 2020/2021 crop year increased slightly in June and then dipped in July. U.S. handlers exported 6,603,182 pounds (inshell basis) through July.

Like the May 2021 Position Report, this most recent publication showed that the year-to-date export total continued to be above recent years. According to the July 2021 position report, U.S. handlers exported a total of 110.70 million pounds (inshell basis) from September 2020 to July 2021. In comparison, handlers exported 96.52 and 103.20 million pounds over the same period in the 2019/2020 and 2018/2019 crop years, respectively.

Country-by-country exports continued to vacillate this July, with some countries receiving more pecans than in previous crop years. According to the July 2021 Position Report, total year-to-date exports to China have more than doubled from the previous year.

Another country of interest, India received 191,520 pounds (inshell basis) from September 2020 to July 2021. Although seemingly an unimpressive number, this year-to-date total indicated that exports to India increased by 340 percent. This crop year, U.S. handlers also sent about 2 million pounds more to the United Kingdom than in the 2019/2020 crop year.

In summary, the July 2021 Position Report showed a sharp decline in U.S. handlers’ inventory in July as pecan imports remain below last year’s levels. At the same time, handlers continued to move nuts through international and domestic markets—outpacing 2018/2019 totals and nearly reaching 2019/2020 numbers.

Previous analysis in Pecan South stated that upcoming reports would influence industry expectations for the market. The June and July 2021 Pecan Position Reports did just that. Through these publications, industry members received insight into the current market before harvest kicks off next month.

Based on the available reports, the industry knows that unlike last year U.S. handlers are entering the season with shorter inventory and fewer uncommitted pecans. Industry members also know that the export market is active and that shipments to grocery stores have increased. How will this knowledge impact prices? That is yet to be seen.

The American Pecan Council generally scheduled each monthly report for release at the end of the following month. By the time APC publishes the next position report, some producers will have started harvest and will be looking to sell their crop.

All 2021 Position Reports can be found at AmericanPecan.com. These reports are subject to updates and revisions as more handlers submit forms and APC staff and USDA review data.